Estimate payroll deductions

Find 10 Best Payroll Services Systems 2022. Calculating your California state income tax is similar to the steps we listed on our Federal paycheck calculator.

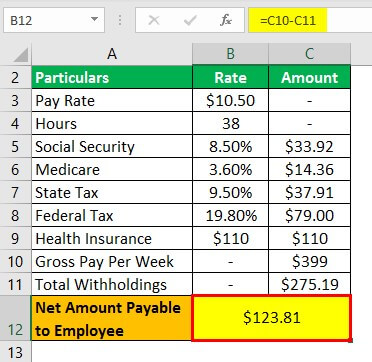

How To Calculate Net Pay Step By Step Example

52 weeks per year every 2.

. Use this handy tool to fine-tune your payroll information and deductions so you can provide your staff with accurate. Sign up make payroll a breeze. Ad Compare This Years Top 5 Free Payroll Software.

Everything You Need For Your Business All In One Place. Easy HR Compliant Payroll And Support From Your Dedicated HR Manager. The Best Online Payroll Tool.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Use this calculator to help you determine the impact of changing your payroll deductions. Calculating payroll deductions doesnt have to be a headache.

You can enter your current payroll information and deductions and. Easy HR Compliant Payroll And Support From Your Dedicated HR Manager. The calculator can help estimate Federal State Medicare and Social Security tax withholdings.

Why Are Payroll Deductions Important. In this example payroll is done biweekly. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Ad The New Year is the Best Time to Switch to a New Payroll Provider. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Get 3 Months Free Payroll.

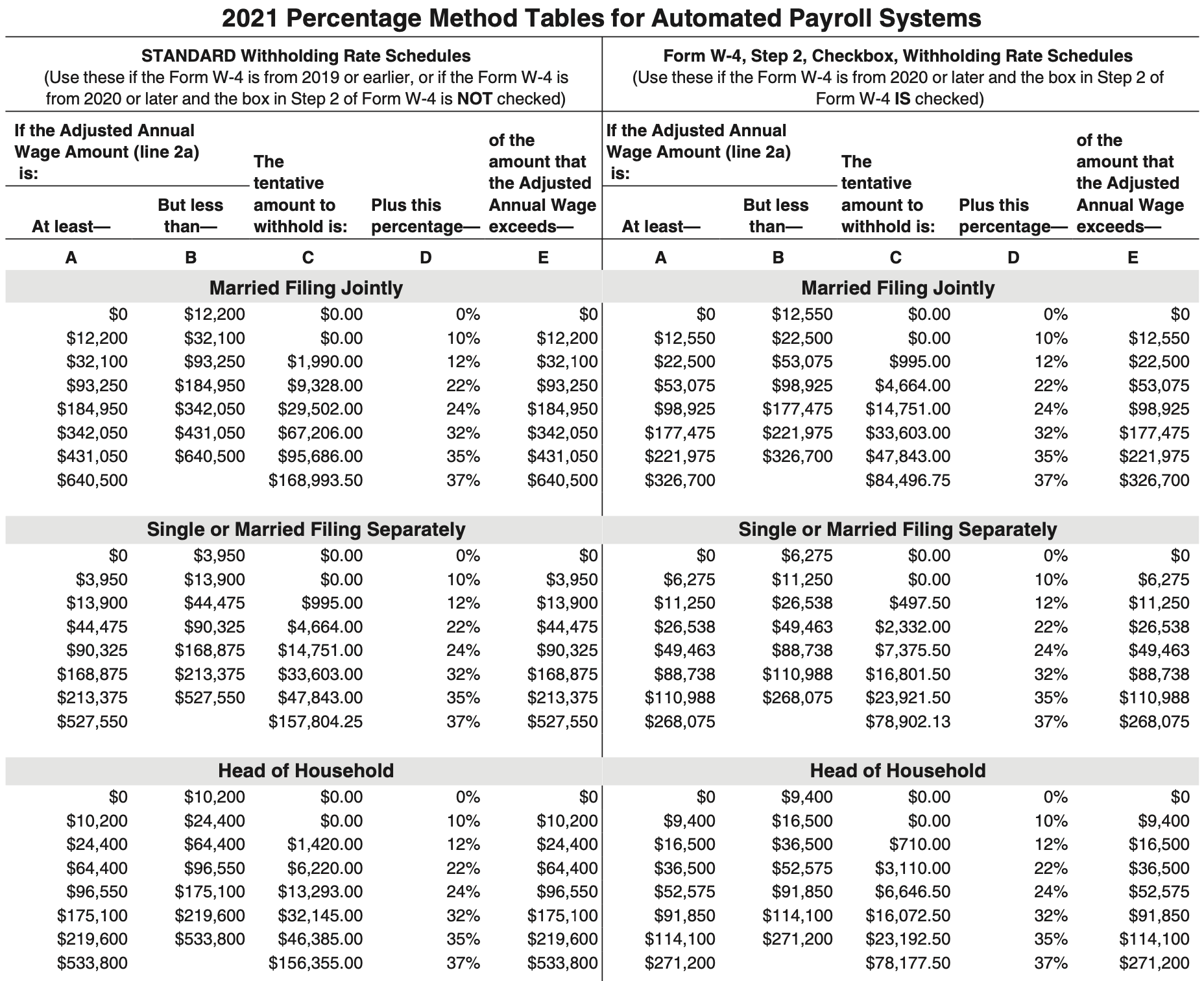

A payroll deductions online calculator lets you calculate federal provincial and territorial payroll deductions for all provinces and territories except Quebec. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions.

Computes federal and state tax withholding for. Ad 4 out of 5 customers reduce payroll errors after switching to Gusto. You can enter your current payroll information and deductions and.

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Use this simplified payroll deductions calculator to help you determine your net paycheck. Convert the MONTHLY cost into a PER PAYROLL cost.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad Ensure Accurate and Compliant Employee Classification for Every Payroll. 2023 Paid Family Leave Payroll Deduction Calculator.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Get an accurate picture of the employees gross pay. Payroll Deductions Calculator Fine-tune your payroll information and deductions so you can provide your staff with accurate paychecks and get deductions right.

Simply the best payroll software for small business. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. For example if an employee earns 1500 per week the individuals.

First you need to determine your filing status. Use our free calculator tool below to help get a rough estimate of your employer payroll taxes. This number is the gross pay per pay period.

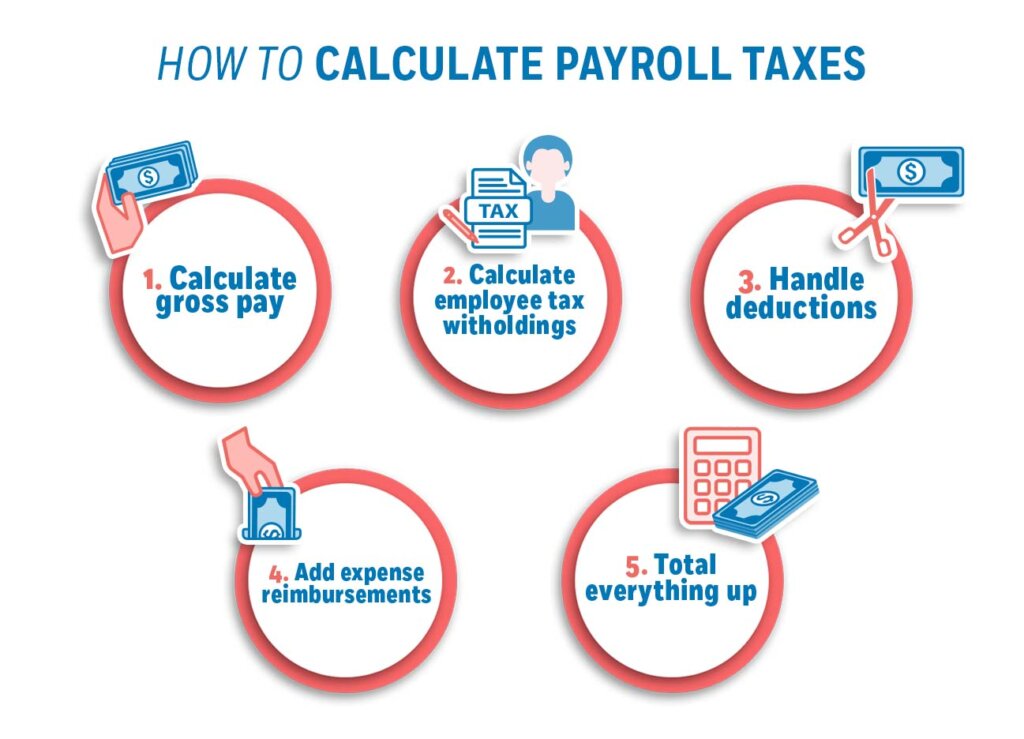

Therefore we know there are 26 payrolls per year. Fast Easy Affordable Small Business Payroll By ADP. Calculate your paycheck in 5 steps There are five main steps to work out your income tax federal state liability or refunds.

Ad Get It Right The First time With Sonary Intelligent Software Recommendations. Focus on Running your Business with the Right Payroll Solutions. Compare the Best Now.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. The maximum an employee will pay in 2022 is 911400. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross wages.

Ad Learn How To Make Payroll Checks With ADP Payroll. Get 3 Months Free Payroll. Payroll Deductions Online Calculator Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Free Unbiased Reviews Top Picks. Subtract any deductions and. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

How to use a Payroll Online. Ad Payroll Done For You. Affordable Easy-to-Use Try Now.

A federal income tax bill of 12000 is usually easier for an employee to pay in 500 increments twice a month through payroll deductions. Ad Ensure Accurate and Compliant Employee Classification for Every Payroll. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

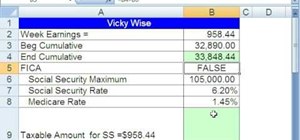

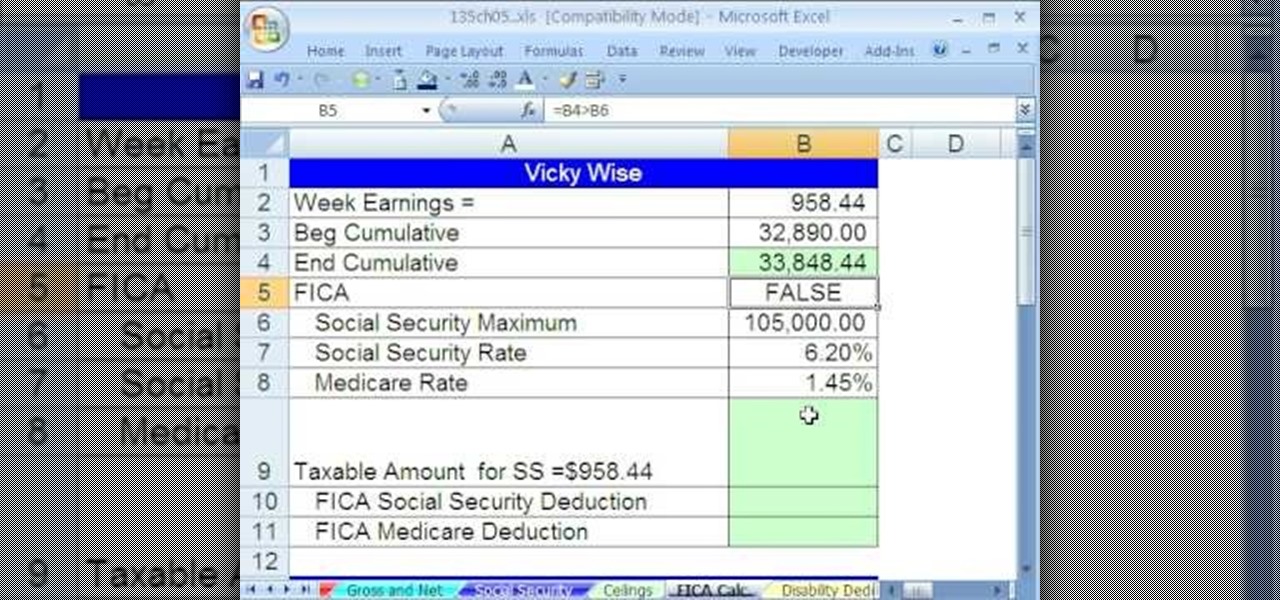

How To Calculate Payroll Deductions Given A Hurdle In Excel Microsoft Office Wonderhowto

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Opentaxsolver Payroll Deduction Calculator

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Payroll Formula Step By Step Calculation With Examples

Payroll Tax Calculator For Employers Gusto

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Solved W2 Box 1 Not Calculating Correctly

Enerpize The Ultimate Cheat Sheet On Payroll

How To Calculate Payroll Taxes Methods Examples More

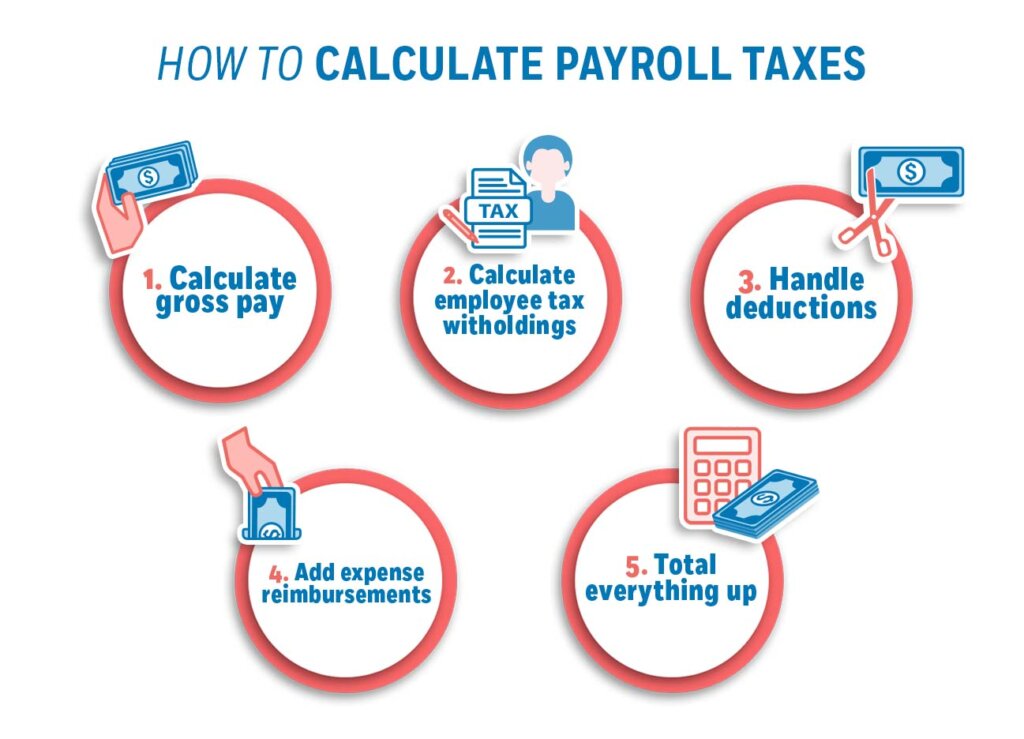

How To Calculate Payroll Taxes In 5 Steps

How To Calculate Payroll Deductions Given A Hurdle In Excel Microsoft Office Wonderhowto

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Opentaxsolver Payroll Deduction Calculator